Divergence indicator is a very common and useful tool in technical analysis. It indicates possible reversal signals when there are discrepancies between an indicator and price movement. For more details of the general definition of divergence indicator please check this link: https://goo.gl/GTJy17

For all of our divergence indicators, we define exaggerated divergence as regular divergence.

What is RSI Double Divergence?

The concept of Double divergence is straightforward. It is triggered when there are two continuous divergences in a row between current High and previous Peak. Comparing to normal divergence indicator, the double divergence indicator gives confirmations two at a time, which is more reassuing and revealing.

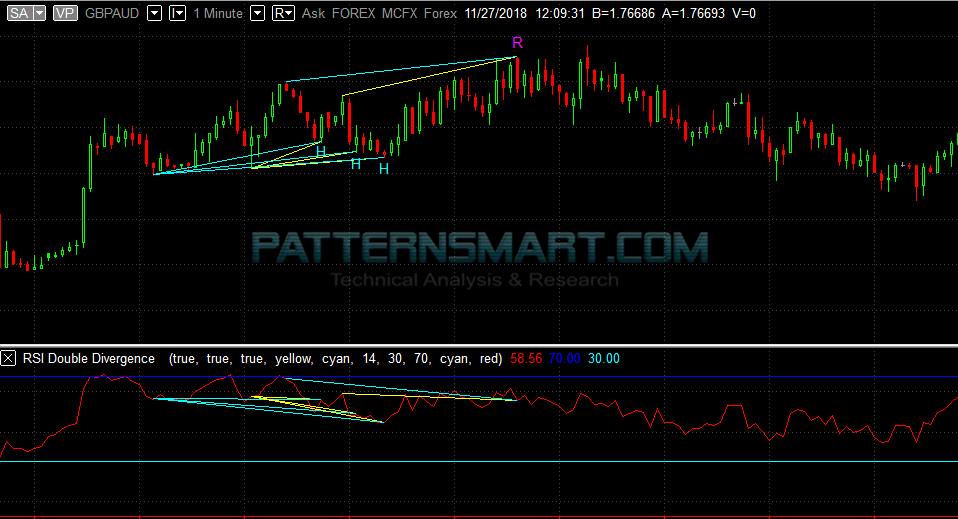

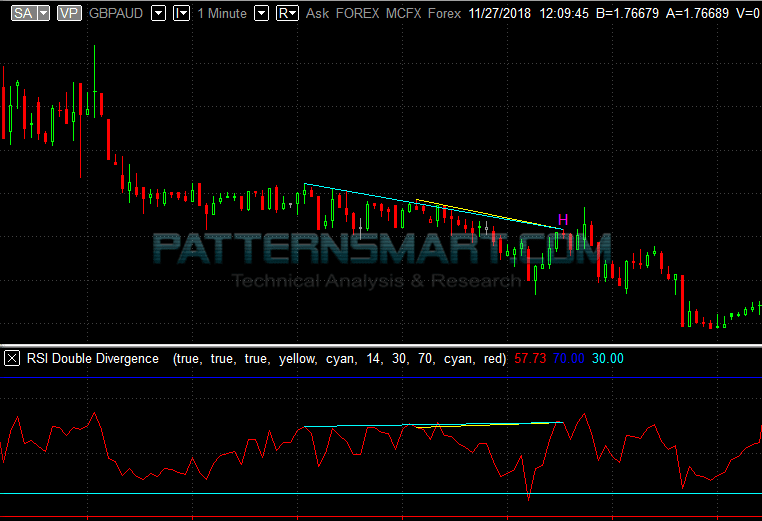

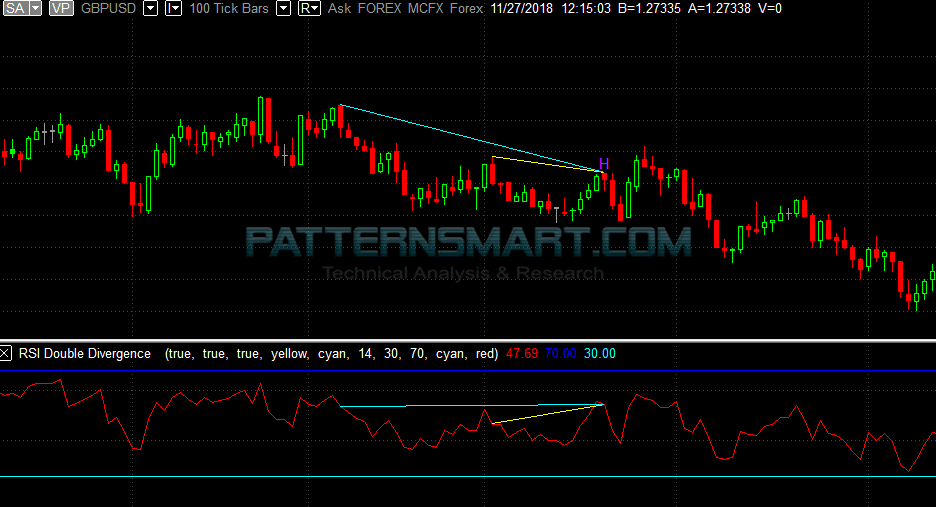

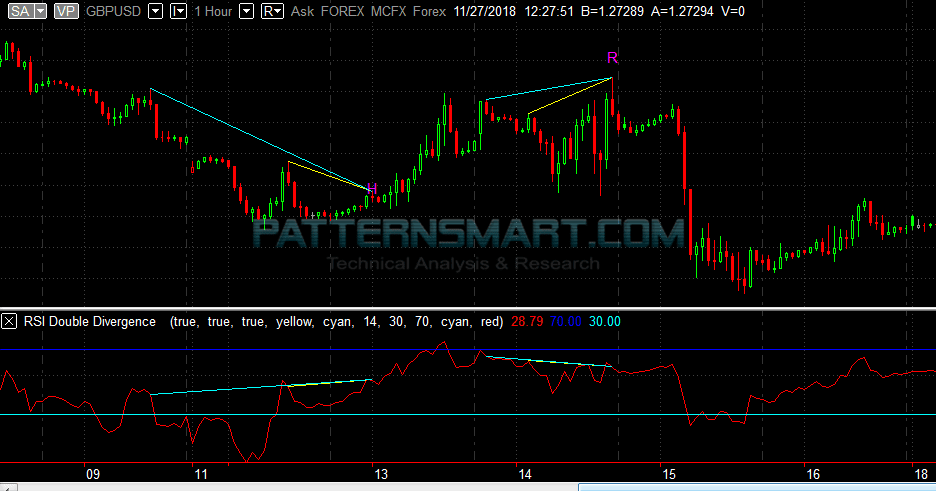

For example, the chart below shows a regular bearish RSI Double divergence and a hidden bullish RSI Double divergence.

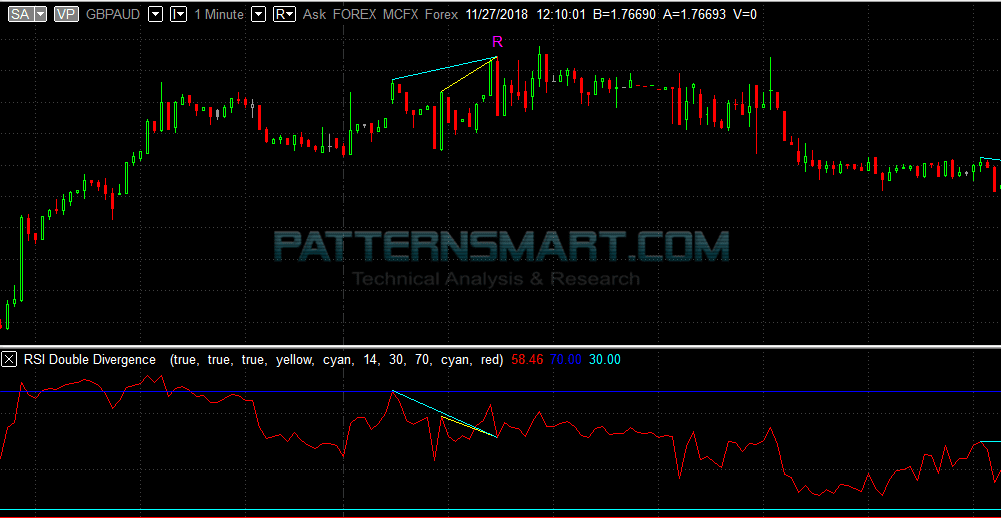

The following chart shows the regular bullish RSI Double divergence and hidden bearish RSI Double divergence.

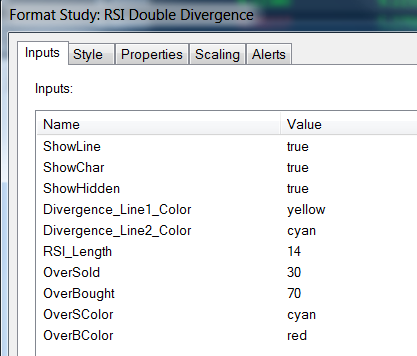

Features and inputs:

This indicator will draw the following at the end of a bar:

- a letter R above a bar if there is a Regular bearish divergence occurred.

- a letter H above a bar if there is a Hidden bearish divergence occurred.

- a letter R below a bar if there is a Regular bullish divergence occurred.

- a letter H below a bar if there is a Hidden bullish divergence occurred.

- two lines from signal bar’s High to previous peaks if there is a Regular bearish divergence occurred.

- two lines from signal bar’s Low to previous troughs if there is a Regular bullish divergence occurred.

- two lines from signal bar’s RSI value to previous peaks or troughs RSI values.

- Instant signal right after on current bar close, no repaint.

- Alert when a signal appear.

- Select different sound alert files.

- Enable to show divergence trend lines.

- Please use the following available colors for divergence line color: Black Blue Cyan DarkBlue DarkBrown DarkCyan DarkGray DarkGreen DarkMagenta DarkRed DarkYellow Green LightGray Magenta Red White Yellow

- Please note: it only works on regular and Heikin–Ashi chart.

- Control the RSI inputs at the same time.

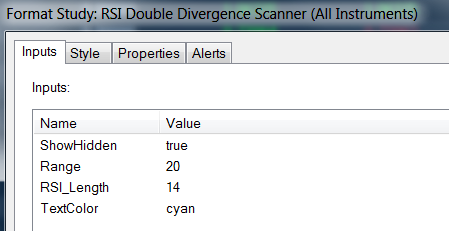

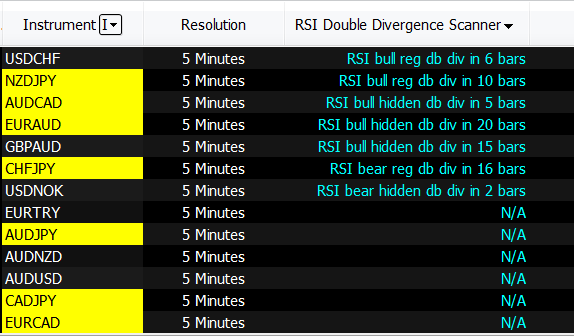

This package also comes with a scanner, it will display when the last DOUBLE DIVERGENCE occured.

Please make sure you select “RSI Double Divergence Scanner” in Scanner, not “RSI Double Divergence”.

It has less input than the DOUBLE DIVERGENCE indicator.

- ShowHidden, if set to true it will scan both hidden and regular DOUBLE DIVERGENCE.

if set to false it will only scan regular DOUBLE DIVERGENCE.

- Range, is the number of bars to check the existence of DOUBLE DIVERGENCE.

If set it to 20 it will only check if there was a DOUBLE DIVERGENCE within the last 20 bars.

If set it to 10 it will only check if there was a DOUBLE DIVERGENCE within the last 10 bars.

For example, as the selected row in the image below, there’s a RSI bullish hidden double divergence detected at 1 bar ago of GBPJPY 5 minutes chart.

Please make sure you use the same inputs for both indicator and scanner.

The following videos show how it plots in realtime replay.