|

Downside Gap Three Methods |

How to Identify:

The 1st and the 2nd bars are long and bearish and continue the downtrend;

The 2nd bar gaps down from the 1st one;

The 3rd bar is bullish and its body covers the gap between the two previous bars.

We use our unique data-mining algorithm to capture specific price movement and pattern performance.

As you know, under certain circumstances, a Bearish pattern can also perform as a Bullish pattern, and a reversal pattern can be changed into a continuation pattern.

If you want to find out the performance of this pattern in real market, not in theory, our data mining results are your must have reference.

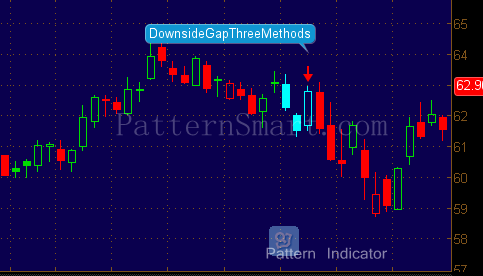

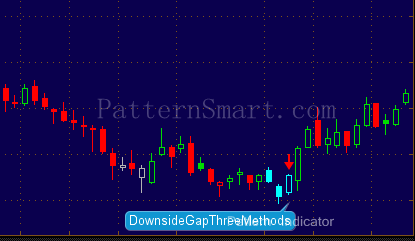

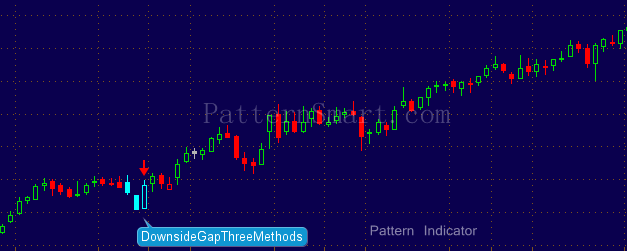

The following pictures are taken from our Candlestick Pattern Indicator (Thinkorswim version).